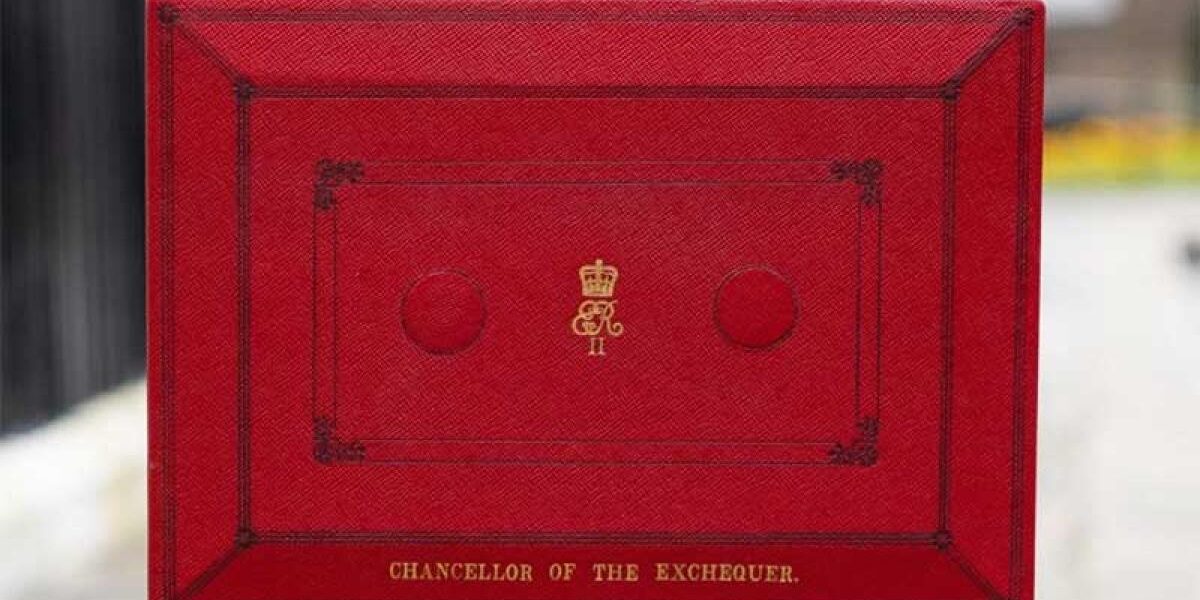

A summary of how the Budget 2025 affects Northern Ireland businesses.

The Chancellor, Rachel Reeves, delivered the Budget announcement on Wednesday 26 November 2025. We provide a summary of the announcements to help you understand their potential impact on your business.

Growth forecast

- 1.5% of Gross Domestic Product (GDP) in 2025

- 1.4% of GDP in 2026

- 1.5% of GDP in 2027

- 1.5% of GDP in 2028

- 1.5% of GDP in 2029

Debt forecast

- 83.3% of GDP in 2026-27

- 83.6% of GDP in 2027-28

- 83.7% of GDP in 2028-29

- 83.0% of GDP in 2029-30

- 82.2% of GDP in 2030-31

Borrowing forecast

- 3.5% of GDP in 2026-27

- 3.0% of GDP in 2027-28

- 2.6% of GDP in 2028-29

- 1.9% of GDP in 2029-30

- 1.9% of GDP in 2030-31

Northern Ireland-specific announcements

The NI Executive will receive an additional £370 million through the Barnett formula.

To boost trade between Northern Ireland and Great Britain, £16.55 million will be provided over three years from 2026-27. This will create a one-stop-shop support service that will help businesses navigate the Windsor Framework, unlock opportunities for trading across the UK internal market, and enable businesses based in Northern Ireland to take advantage of their access to UK and EU markets.

The government will fund the Northern Ireland Executive to remove the two-child limit in Universal Credit for families in Northern Ireland, should it choose to do so, as welfare is devolved.

Minimum wage rate

The National Minimum Wage and National Living Wage rates will increase from 1 April 2026 to:

- £12.71 per hour for over 21s

- £10.85 per hour for 18-20 year olds

- £8.00 per hour for 16-17 year olds and apprentices

See minimum wage rates increase from 1 April 2026.

Personal taxation

Income tax and national insurance thresholds will be frozen for an extra three years from 2028.

Property income

The government will create separate tax rates for property income. From 2027-28, the property basic rate will be 22%, the property higher rate will be 42%, and the property additional rate will be 47%.

ISA reform

From 6 April 2027, the annual ISA cash limit will be set at £12,000, within the overall annual ISA limit of £20,000. Annual subscription limits will remain at £20,000 for ISAs, £4,000 for Lifetime ISAs and £9,000 for Junior ISAs and Child Trust Funds until 5 April 2031. Savers over the age of 65 will continue to be able to save up to £20,000 in a cash ISA each year.

Pensions

The basic and new state pension payments are to go up by 4.8% from April 2026.

People paying into their pension pot under salary sacrifice schemes to start paying National Insurance contributions above £2,000 a year from 6 April 2029.

Customs duty relief

The government is removing the customs duty relief on goods imported into the UK valued at £135 or less, making them subject to customs duty from March 2029.

Venture Capital Trust (VCT) and Enterprise Investment Scheme (EIS)

The government will increase the VCT and EIS company investment limit to £10 million, and £20 million for Knowledge Intensive Companies (KICs) and increase the lifetime company investment limit to £24 million, and £40 million for KICs. The gross assets test will increase to £30 million before share issue, and £35 million after, from April 2026. Alongside this, the VCT income tax relief will decrease to 20%. These changes will be legislated in the Finance Bill 2025-26.

Soft Drinks Industry Levy (SDIL)

The government will reduce the threshold at which the SDIL applies from 5g to 4.5g sugar per 100ml and remove the exemptions for milk-based and milk substitute drinks with added sugar to create a level playing field between pre-packaged beverages. These reforms will be implemented on 1 January 2028, following consultation on the legislation. Open cup beverages, such as those bought in cafes, will remain unaffected.

Gambling taxes

Remote Gaming Duty will increase from 21% to 40% from April 2026. Bets on horseracing will be excluded from the new Remote Betting Rate. Duty on remote horserace betting will remain at 15%.

A new Remote Betting Rate at 25% within General Betting Duty will be introduced from April 2027.

Bingo Duty will be abolished from April 2026.

Tobacco, vaping and alcohol duties

Tobacco duty will rise by two percentage points above the RPI, while alcohol duty goes up inline with RPI.

As previously announced, the government will legislate for the new Vaping Products Duty to be introduced from 1 October 2026 at a flat rate of £2.20 per 10ml applied to all vaping liquids, alongside the Vaping Duty Stamps scheme to support compliance.

Fuel and vehicle duties

The temporary 5p fuel duty cut will be extended for a further five months, until September 2026. This cut will be reversed in three stages:

- 1p on 1 September 2026

- 2p on 1 December 2026

- 2p on 1 March 2027

The planned inflation increase for 2026-27 will not take place, with the government uprating fuel duty rates by Retail Prices Index (RPI) from April 2027.

Vehicle taxes and motor industry

The government is introducing Electric Vehicle Excise Duty (eVED), a new mileage charge for electric and plug-in hybrid cars, with effect from April 2028. Drivers will pay for their mileage on a per-mile basis alongside their existing Vehicle Excise Duty. Electric cars will pay half the equivalent fuel duty rate for petrol and diesel cars, and plug-in hybrid cars will pay a reduced rate equivalent to half of the electric car rate.

Vehicle Excise Duty for cars, vans, motorcycles and heavy goods vehicles will increase in line with RPI from 1 April 2026.

Employee car ownership schemes

To allow more time to prepare for employee car ownership schemes to be brought into the scope of Benefit in Kind rules, its implementation will be delayed to 6 April 2023, with transitional arrangements until April 2031.

The government will introduce a temporary benefit in kind tax easement for plug-in hybrid electric vehicles (PHEVs) in the Benefit in Kind system to prevent their tax charge increasing significantly due to new emissions standards. This easement will be in place from 1 January 2025 to 5 April 2028.

The government will extend funding for the DRIVE35 programme, with an additional £1.5 billion to 2035, providing a total of £4 billion over the next 10 years.

The government will provide an additional £1.3 billion funding for the Electric Car Grant and extend funding to 2029-30.

Employee Ownership Trusts

The government will reduce the Capital Gains Tax relief available on qualifying disposals to Employee Ownership Trusts from 100% of the gain to 50%. This will take effect from 26 November 2025.

Source: nibusinessinfo