HM Revenue & Customs (HMRC) webinars to explain how the off-payroll working rules will change on 6 April 2021

How the off-payroll working rules are applied will change on 6 April 2021.

Before 6 April 2021, if your worker provides services to a client through you:

- in the public sector, the client must decide your employment status

- in the private sector, you must decide your worker’s status

From 6 April 2021, all public sector clients and medium or large-sized private sector clients will be responsible for deciding your worker’s employment status. This includes some charities and third sector organisations.

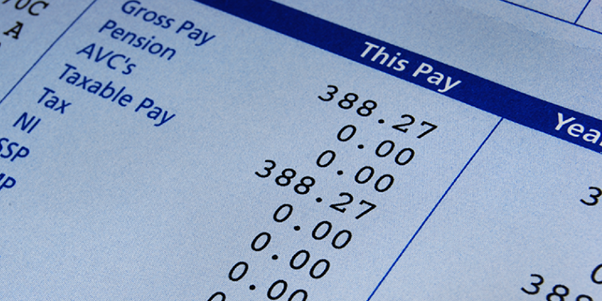

If the off-payroll working rules apply, your worker’s fees will be subject to tax and National Insurance contributions. Read more about the April 2021 changes to off-payroll working for intermediaries.

Webinars to help you prepare

HMRC are hosting a number of free webinars to help businesses in key areas prepare for this change in off-payroll working, including:

Webinar: Off-payroll working rules from April 2021 for contractors

Date: Mon 18 Jan

Time: 9:45-10:45am

Webinar: Off-payroll working rules from April 2021 for medium and large sized organisations and the public sector

Date: Wed 20 Jan

Time: 9:45-10:45am

Webinar: Off-payroll working rules from April 2021 and international matters

Date: Thu 21 Jan

Time: 3:45-4:45pm

View all HMRC live and recorded webinars

Source: NIBUSINESSINFO